s corp dividend tax calculator

Taxes Paid Filed - 100 Guarantee. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

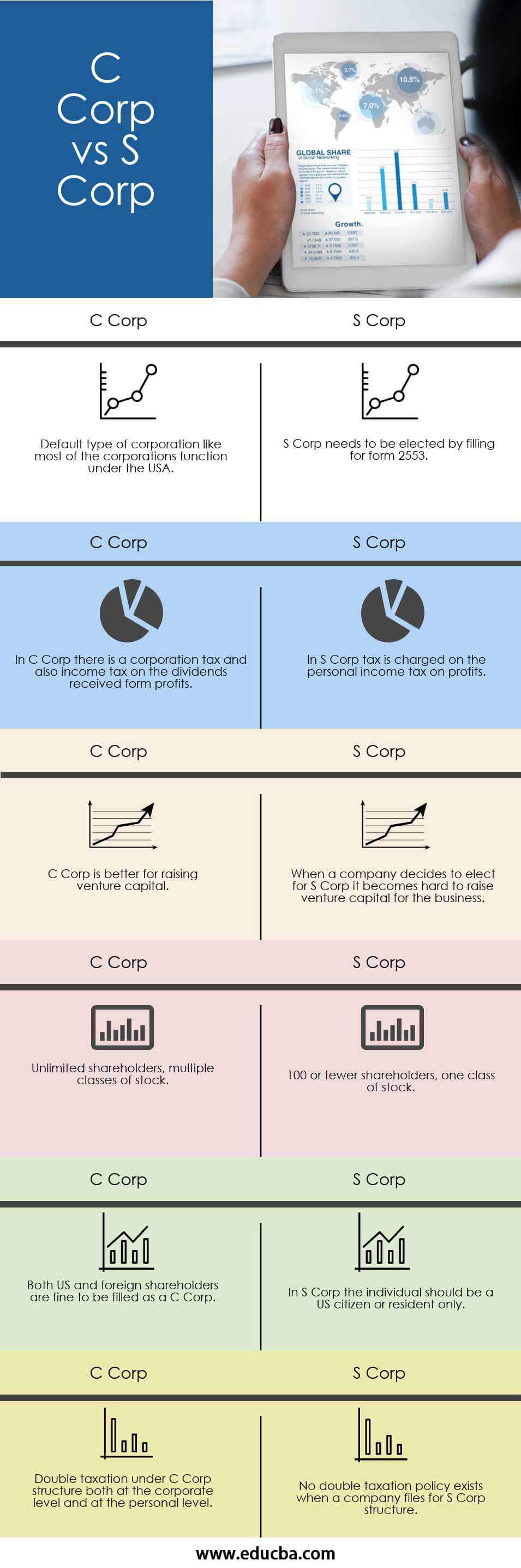

What Is A C Corporation What You Need To Know About C Corps Gusto

765 153 Employees Tax Burden Employers Tax Burden VIEW CALCULATOR Being Taxed as an S-Corp Versus LLC If your business has net income of 70000 and youre taxed as an LLC.

. Our calculator will estimate whether electing S corp will result in a tax win for your business. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited. This tax calculator shows these values at.

2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder. Or other income from a trust estate partnership LLC or S corporation. The dividend tax rates for dividends that exceed the set allowance are.

Dividend Tax Rates for the 2021 Tax Year. Our calculator will estimate whether electing S corp will result in a tax win for your business. Dividend Tax Rates for the 2021 Tax Year.

The tax rate on nonqualified dividends is the same as your regular. 1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

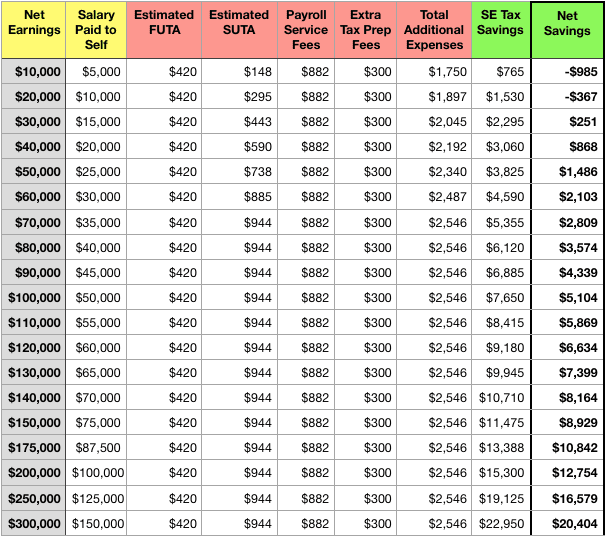

How much can I save. The SE tax rate for business owners is 153 tax. 21020 Annual Self Employment tax as an S-Corp 19125 You Save.

Enter your salarydividend amounts into the yellow boxes below and. S corp dividend tax calculator Tuesday March 1 2022 Edit. Its also possible you get a Schedule K-1 if you invest in a.

For example if your one-person S corporation makes 200000 in profit and a. 0 12570 0 personal allowance 12571 50270 75. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Taxes Paid Filed - 100 Guarantee. Determine a reasonable salary for the. If we use 10 as our cost of equity and expect Reality Income Corps dividend to.

Say for example that you get. Dividend tax calculator Tax year 202122 Tax and profit Your dividend profits 3000 Dividend tax to pay 75 2000 tax-free dividend allowance Profit after tax 2925 You can either call HMRC. Overhead include yours and others salaries but not FICA tax Salary Paid to You.

Determine a reasonable salary for the. S Corp Tax Calculator Free estimate of your tax savings becoming an S Corporation. If income is standard income you would pay the standard income tax rates.

If youre a basic-rate payer youll pay 75 on dividend income. But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes 0 usually 15 and worst-case 20. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the.

Enter your tax profile to get your full tax report. Before using the calculator you will need to. If an S corp allocates 125000 profit to you the shareholder the character of such income is important.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. Our salary and dividend tax calculator calculates tax payable on dividends and you can use it to calculate how much tax youll pay on the dividends youll earn in the current tax year. NSC Complete Norfolk Southern Corp.

Tax calculator based on 2018 Tax Law. Use our calculator to work out how much tax you will incur on any combination of salary and dividends. Unlike partnerships S corporations are not.

Above your dividend allowance youll pay tax at the rate you pay your other income - known as your marginal tax rate. Enter your estimated annual business net income and the reasonable salary you will pay. Before using the calculator you will need to.

S Corp Savings Calculator Feeling. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Effective Tax Rate Formula Calculator Excel Template

Dividend Tax Calculator 2022 23

Dividend Tax Calculator Taxscouts

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

S Corp Vs Llc Difference Between Llc And S Corp Truic

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Llc Tax Calculator Definitive Small Business Tax Estimator

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Effective Tax Rate Formula Calculator Excel Template

How To Convert An Llc To An S Corp Truic

S Corp Vs Llc Difference Between Llc And S Corp Truic

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

The Schedule K 1 Form Explained The Motley Fool